Contents:

You have already added five stocks to your watchlist. Upgrade to MarketBeat All Access to add more stocks to your watchlist. One share of FFBC stock can currently be purchased for approximately $20.70.

/ Sales ,40x Nbr of Employees Free-Float 97,6% More FinancialsCompanyFirst Financial Bancorp. We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management.

First Financial (FFBC) Moves 8.4% Higher: Will This Strength Last?

The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. Even though many regional banks demonstrated that they benefited from rising interest rates, regional bank indices show that investors were not impressed. Deposits have decreased and provisions for credit losses are rising. FRB plummeted another 30% to under $6 per share, valuing the business at a $1 billion market cap. The Treasury, the Federal Reserve and the FDIC have reportedly met with several financial companies to help hash out a rescue deal for First Republic.

It’s often used to measure a company’s size. In the Morningstar Style Box, large-cap names account for the largest 70% of U.S. stocks, mid-cap names account for the largest 70–90%, and small-cap names are the remaining 10% of companies. Dividend yield allows investors, particularly those interested in dividend-paying stocks, to compare the relationship between a stock’s price and how it rewards stockholders through dividends. The formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price. The company also recently disclosed a quarterly dividend, which was paid on Wednesday, March 15th.

Since 1988 it has more than doubled the S&P 500 with an average gain of +24.27% per year. These returns cover a period from January 1, 1988 through April 3, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return.

And its competitors with parity the data recruitment and consultingBeat’s FREE daily newsletter. 73.35% of the stock of First Financial Bancorp. High institutional ownership can be a signal of strong market trust in this company.

FFBC has a forward dividend yield of 4.44%.SeeFFBC’s full dividends and stock split historyon the Dividend tab. 39 employees have rated First Financial Bancorp. Chief Executive Officer Archie Brown on Glassdoor.com. Archie Brown has an approval rating of 100% among the company’s employees. This puts Archie Brown in the top 10% of approval ratings compared to other CEOs of publicly-traded companies. 83.0% of employees surveyed would recommend working at First Financial Bancorp.

Other Services

First Financial Bancorp.’s stock was trading at $24.23 at the start of the year. Since then, FFBC stock has decreased by 14.6% and is now trading at $20.70. View the best growth stocks for 2023 here. In the past three months, First Financial Bancorp.

First Financial: Q1 Earnings Snapshot – Seattle PI

First Financial: Q1 Earnings Snapshot.

Posted: Thu, 20 Apr 2023 20:37:04 GMT [source]

We’d like to share more about how we work and what drives our day-to-day business. Our Quantitative Research team models direct competitors or comparable companies from a bottom-up perspective to find companies describing their business in a similar fashion. WASHINGTON — The Treasury Department announced Monday that it intends to dispose of warrant positions in eight banks that it acquired as part of the bailout of the banking system in the fall of 2008.

First Financial Bancorp to Announce First Quarter 2023 Financial Results on Thursday, April 20, 2023

© 2023 https://1investing.in/ data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‚as-is‘ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer. Sign-up to receive the latest news and ratings for First Financial Bancorp.

- And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

- These returns cover a period from January 1, 1988 through April 3, 2023.

- This puts Archie Brown in the top 10% of approval ratings compared to other CEOs of publicly-traded companies.

- StockNews.com started coverage on shares of First Financial Bancorp.

Pays quarterly dividends to shareholders. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating indiv idual securities. Exchanges report short interest twice a month.Percent of FloatTotal short positions relative to the number of shares available to trade.

Financial Performance

This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to First Republic Bank is in trouble, and all market participants await today’s earnings to learn the extent of the bank’s challenges. The stock is down 87% since the regional banking turmoil began in March. Price/book ratio can tell investors approximately how much they’re paying for a company’s assets, based on historical, rather than current, valuations. Historical valuations generally do not reflect a company’s current market value.

Further, it provides a range of trust and wealth management services; and lease and equipment financing services. The company was founded in 1863 and is headquartered in Cincinnati, Ohio. First Financial Bancorp is a mid-sized, regional bank holding company. First Financial utilizes a community banking business model and serves a combination of metropolitan and non-metropolitan markets through full-service banking centers around Indiana, Ohio, and Kentucky.

What is First Financial Bancorp’s stock style?

73.35% of the stock is currently owned by hedge funds and other institutional investors. Get MarketBeat All Access Free for 30 DaysMarketBeat All Access is the premier all-in-one stock research solution that helps you identify the best stocks, monitor your portfolio, and keep track of the market. You get our top stock picks, best-in-class research tools, real-time alerts, proprietary research reports and much more. Has received a consensus rating of Hold. The company’s average rating score is 2.00, and is based on no buy ratings, 3 hold ratings, and no sell ratings. This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting.

20 bank stocks expected to benefit the most from rising interest rates as the Federal Reserve fights inflation – MarketWatch

20 bank stocks expected to benefit the most from rising interest rates as the Federal Reserve fights inflation.

Posted: Wed, 17 Aug 2022 07:00:00 GMT [source]

Net money flow is the value of uptick trades minus the value of downtick trades. Our calculations are based on comprehensive, delayed quotes. Consensus Price Target is the stock price analysts expect to see within a period of 0-18 months. Provide specific products and services to you, such as portfolio management or data aggregation. Intraday Data provided by FACTSET and subject to terms of use.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market. Morningstar Quantitative ratings for equities are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings.

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more. Clients forget how much they should be earning in their savings accounts since we’ve become accustomed to earning nearly zero these past few years. Now you can earn above 4%, which is a meaningful difference. All values as of most recently reported quarter unless otherwise noted. Verify your identity, personalize the content you receive, or create and administer your account.

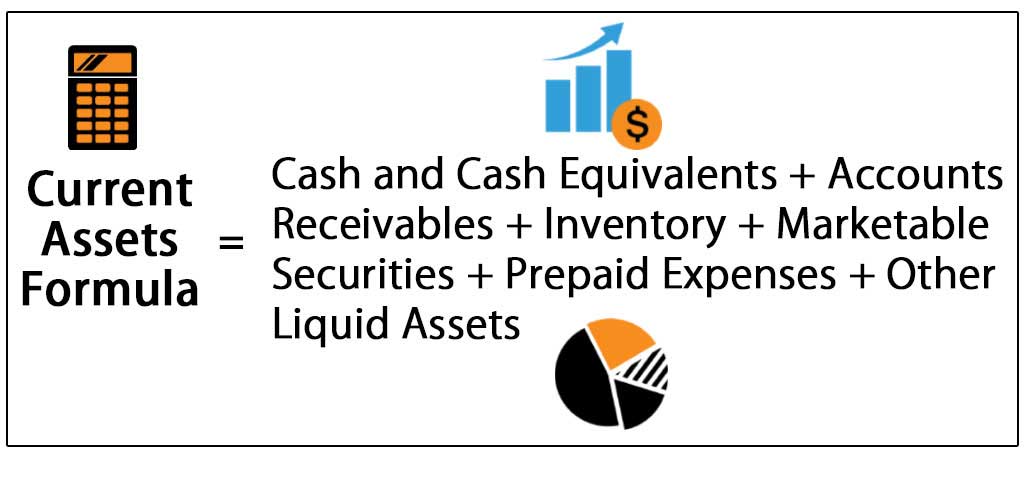

The company has a quick ratio of 0.89, a current ratio of 0.89 and a debt-to-equity ratio of 0.68. The company has a market capitalization of $1.90 billion, a price-to-earnings ratio of 7.66 and a beta of 1.06. Has a 52-week low of $18.75 and a 52-week high of $26.72.

Has received a 38.37% net impact score from Upright. Based on earnings estimates, First Financial Bancorp. Will have a dividend payout ratio of 38.33% next year.

- The industry with the worst average Zacks Rank would place in the bottom 1%.

- It’s shaken confidence in the embattled regional banking sector and raised concerns that we haven’t seen the last of bank runs and collapses.

- You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer.

- We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view.

- High-growth stocks tend to represent the technology, healthcare, and communications sectors.

The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations.

Hinterlasse einen Kommentar

Du musst angemeldet sein, um einen Kommentar schreiben zu können.