Once all necessary corrections have been made and adjusted accounts reflect updated balances, this trial balance becomes known as an adjusted trial balance. Once all adjustments are made to the unadjusted trial balance, we will have the adjusted trial balance. And this is the main reason that makes these two statements different. Let’s now take a look at the T-accounts and unadjusted trial balance for Printing Plus to see how the information is transferred from the T-accounts to the unadjusted trial balance.

How to cut the cost on your financial transactions

The goal is to maintain accounting accuracy before adjusting entries come into play. Double-entry accounting helps here by requiring a debit and credit for each transaction. A clear picture of a company’s financial status that’s ready for deeper analysis during financial reporting. Each side—debits and credits—should mirror each other in total if everything is recorded correctly. If they don’t match, accountants know they have some detective work to do to find errors or omissions that could affect financial position accuracy later on.

How to Find Net Income From Unadjusted Trial Balance?

By highlighting these mistakes, the trial balance acts as an accuracy check for a business, mitigating the risk of inaccuracies before you generate final financial statements. Creating an unadjusted trial balance is not just about finding errors though; it sets the stage for making important adjustments later on. These fine-tunings help present a true financial position before final reports are prepared.

Why is it important to prepare the unadjusted and adjusted trial balance?

Alternatively, if the company only creates financial statements once a quarter, you would print the unadjusted trial balance on a quarterly basis. By providing a snapshot of all ledger accounts within a given accounting period, the trial balance helps business owners and accounting teams in reviewing accuracy. You record all your accounting transactions and post them to the general ledger, then assess the debit and credit totals. The biggest goal of a trial balance is to find accounting errors and transposition errors like switching digits.

Step 3 of 3

However, most businesses can streamline this cycle and skip tedious steps like posting transactions to the general ledger and creating a trial balance. Using accounting software like QuickBooks Online can do all these tasks for you behind the scenes. Trial balances come in three key types, with each serving a purpose to help create accurate financial statements. A trial balance is an internal report that itemizes the closing balance of each of your accounting accounts.

It lists all account balances from the general ledger before any adjustments are made. This step is crucial because it shows if total debits equal total credits, pointing to possible errors. After analyzing transactions, recording them in the journal, and posting into the ledger, we enter the fourth step in the accounting process – preparing a trial balance. A trial balance simply shows a list of the ledger accounts and their balances. Its purpose is to test the equality between total debits and total credits.

Bookkeepers typically scan the year-end trial balance for posting errors to ensure that the proper accounts were debited and credited while posting journal entries. Internal accountants, on the other hand, tend to look at global trends of each account. For instance, they might notice that accounts receivable increased drastically over the year and look into the details to see why. The beginning trial balance or cost recovery method of revenue recognition simply lists the unadjusted balances for each account. What I mean by unadjusted balances is that none of the year-end balances have been adjusted by year-end adjusting journal entries yet.

- There’s also a chance it’ll fail to flag entries incorrectly coded to the wrong accounts, which can ultimately lead to inaccurate financial statements.

- Bookkeepers and accountants use this report to consolidate all of the T-accounts into one document and double check that all transactions were recorded in proper journal entry format.

- As with all financial reports, trial balances are always prepared with a heading.

- The balances on this trial balance sheet are usually taken from an account ledger or bookkeeping records.

- As you can see, all the accounts are listed with their account numbers with corresponding balances.

- The accounts are listed on the left with the balances under the debit and credit columns.

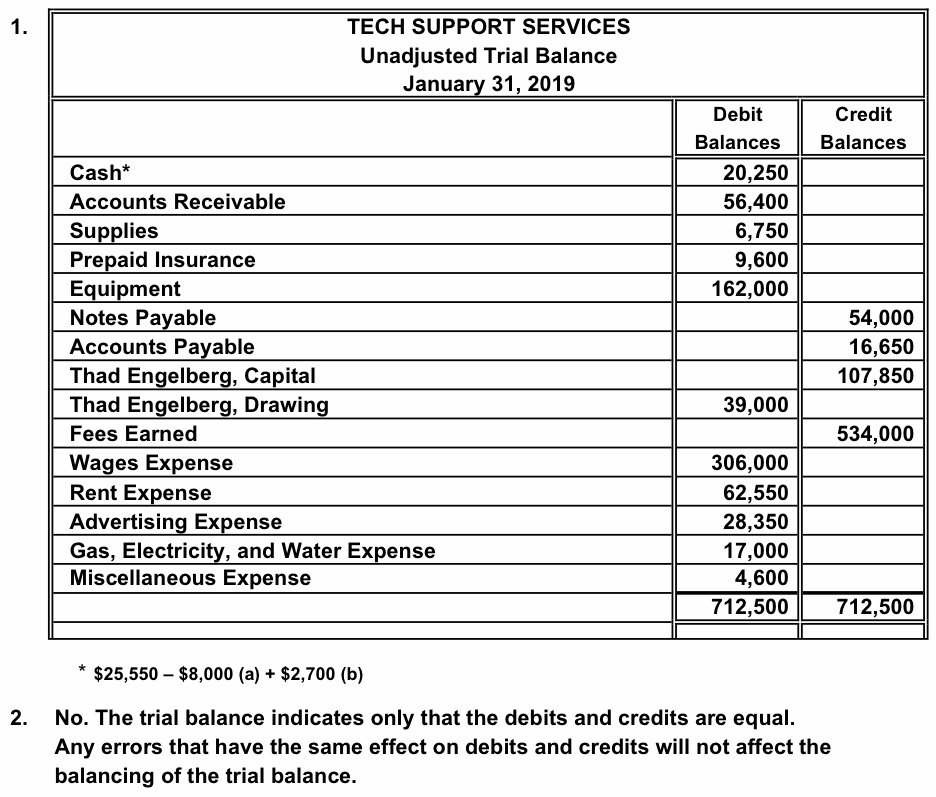

As the name suggests, the unadjusted version has entries that are not adjusted or in order, while the adjusted ones are used to adjust the two sides of the ledger – the debit and credit. Plus, the adjusted trial balance has one extra account mentioned, i.e., net/loss of income. If there is a mismatch in the totals on both sides, the next step is to rectify the errors in the records and prepare an accurate dataset for creating a reliable financial statement. Having an unadjusted trial balance is important because it is the first step in creating financial statements. As with all financial reports, trial balances are always prepared with a heading. Typically, the heading consists of three lines containing the company name, name of the trial balance, and date of the reporting period.

Hinterlasse einen Kommentar

Du musst angemeldet sein, um einen Kommentar schreiben zu können.